DATA

Alternatives.pe has data that others can't get:

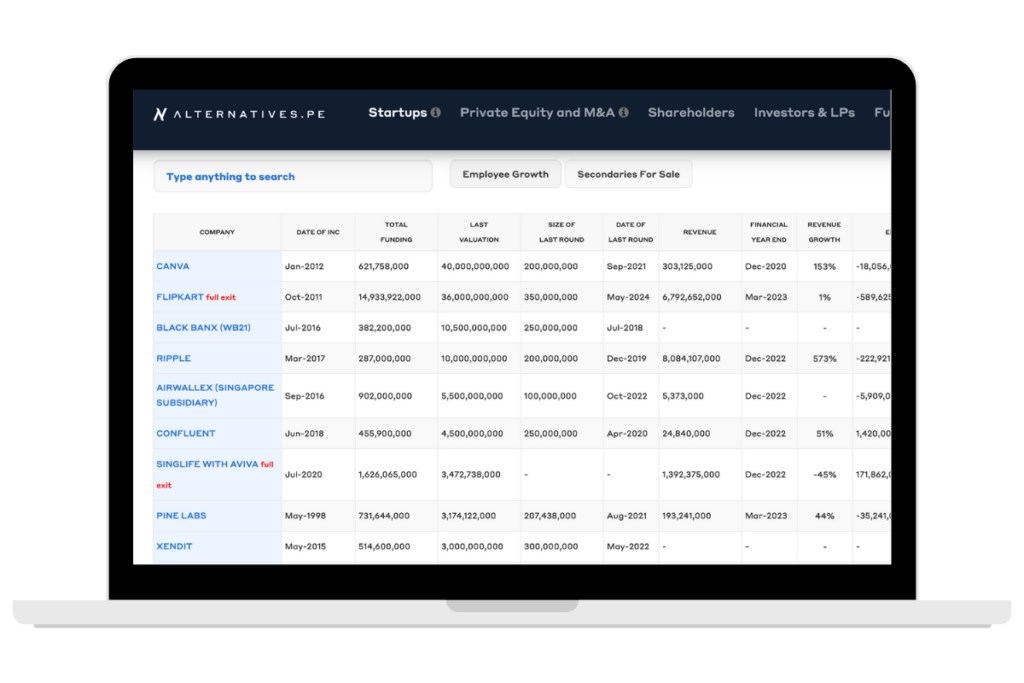

Key Financials and Valuation Data on More Companies & Deals, More Investors & Limited Partners (including Family Offices)

Our Competitive Edge

We understand that accurate & complete information is crucial for making informed investment decisions. That’s why we employ rigorous data collection and verification processes to ensure the highest standards of quality.

3x the number of startups, 2x the Private Equity and M&A events, and 2x the Investor & LP profiles of our competitors. 100% accuracy, compared to an industry standard of less than 60%. Data sourced from regulatory filings, not web crawling, to give us 25% more deals – unannounced – and show data valuations, cap tables and audited financials that competitors can’t.

100% Accuracy

Data you can trust. Our data is sourced from regulatory filings, not from web crawling or volunteered data, which is error-prone

Complete Coverage

We track share transfers and financial filings as they appear in government registries. This means Alternatives offers the broadest data coverage, including data on deals not announced.

Timely Updates

Alternatives provides updates as information is filed, ensuring a blend of accurate and current information.

Expert analysis

Alternatives automates data collection and adds expert curation. Domain specialists and researchers curate and analyse the data, adding valuable insights.

User Friendly Interface

Alternatives also welcomes user contributions, subject to validation.

100% Accuracy

Data you can trust. Our data is sourced from regulatory filings, not from web crawling or volunteered data, which is error-prone.

Complete Coverage

We track share transfers and financial filings as they appear in government registries. This means Alternatives offers the broadest data coverage, including data on deals not announced.

Timely Updates

Alternatives provides updates as information is filed, ensuring a blend of accurate and current information.

Expert analysis

Alternatives automates data collection and adds expert curation. Domain specialists and researchers curate and analyse the data, adding valuable insights.

User-friendly interface

Alternatives also welcomes user contributions, subject to validation. This collaborative approach fosters an engaged community and enriches the database.

Data You Can Trust: 3x More Coverage, 100% Accuracy

Make Smarter Investment Decisions in Private Markets with access to these data sets

Frequently asked questions

What is included in Startup Company Data?

Funding (total and round by round)

Valuations and Share Prices (for every round)

Historical Revenue and EBIT

Detailed Financial Statements

Detailed Cap table

Info on every round

Investors

Amounts invested

Share prices

Number of shares allotted

Companies raising now, with pitch decks for many

Details of secondaries for sale

Details of companies with loans

Details of partial and full exits

Companies with female founders

Filter by

Sector

Country

Stage

Valuation

Total funding

Revenue

Revenue growth

EBIT

EBIT growth

Number of employees

Employee growth, etc.

LinkedIn and Email addresses of founders and directors

And more…

What is included in VC Fund Manager Data?

Company

LinkedIn Page

Website

Description

Phone Number

Year Founded

Country

Email Address

Details & Investment Preferences

Dry Powder

No of Investments

Preferred Deal Type

Preferred Regions & Countries

Preferred Sectors

Preferred Themes

People

Contact Details (email address and/or LinkedIn profile links) for key Decision-makers and Team members

Fund Information

Funds

Investments made by each fund

LP Commitments

Fund Performance (Add On Module)

Net IRR

Net Multiple

DPI

RVPI

Fund Financial Statements

What is included in PE Fund Manager Data?

-

Company

-

LinkedIn Page

-

Website

-

Description

-

Phone Number

-

Year Founded

-

Country

-

Email Address

-

-

Details & Investment Preferences

-

Dry Powder

-

No of Investments

-

Preferred Deal Type

-

Preferred Regions & Countries

-

Preferred Sectors

-

Preferred Themes

-

-

People

-

Contact Details (email address and/or LinkedIn profile links)

for key Decision-makers and Team members

-

-

Fund Information

-

Funds

-

LP Commitments

-

What is included in M&A or PE Data?

Company

Website

Description

Year Founded

Transaction Date

Valuation

Transaction Description

Key Financials (Revenue, EBIT, Liabilities)

Detailed Financials

Total Funding, Cap Table and all Investors in the M&A or PE event

LinkedIn links to Founders & Directors

What is included in Limited Partner Data?

Company LinkedIn Page

Company Website

Company Short Description

Company Phone Number

Company Year Established

Company Country (Main and Additional)

Company Email Address

Preferred:

Sectors/Industries

Deal types (eg Seed, Series A etc)

Technology Themes

Geography/Regions

Funds they have Commitments to

Firm Type

AUM

Commitment Size (Min/Max)

Co-Invest Flag

First Time Fund Flag

Separate Account Flag

VC/PE Target Allocation

VC/PE Current Allocation

Route to Market

What is included in Family Office Data?

Company LinkedIn Page

Company Website

Company Short Description

Company Phone Number

Company Year Established

Company Country (Main and Additional)

Company Email Address

Preferred:

Sectors/Industries

Deal types (eg Seed, Series A etc)

Technology Themes

Geography/Regions

AUM

Dry Powder

Check Size (Min)

Check Size (Max)

Count of Investments

Valuation

Data points we collect

Comprehensive insights into companies, investors, and funds operating in Southeast Asia & Australia. Key data points include:

Make Investment Decisions Backed By 100% Accurate Data

With 100% accurate data, sourced directly from regulatory filings and updated daily, your decision making will be sharper than ever before.

Unrivaled Intelligence Into Private Equity, M&A & VCs In The Region

We deliver 3x more coverage than our competitors in Southeast Asia and Australia. Get everything you need on Start ups, VC and PE fund managers, Limited Partners, Family Offices and M&A deal transactions.

Spot the Best Opportunities In a Fraction of Time

Stay ahead of the curve, our easy-to-use interface streamlines your research so you can spot potential opportunities effortlessly.

With reliable data from Alternatives, identifying emerging trends, tracking investor behaviour, and evaluating company valuations becomes frictionless.

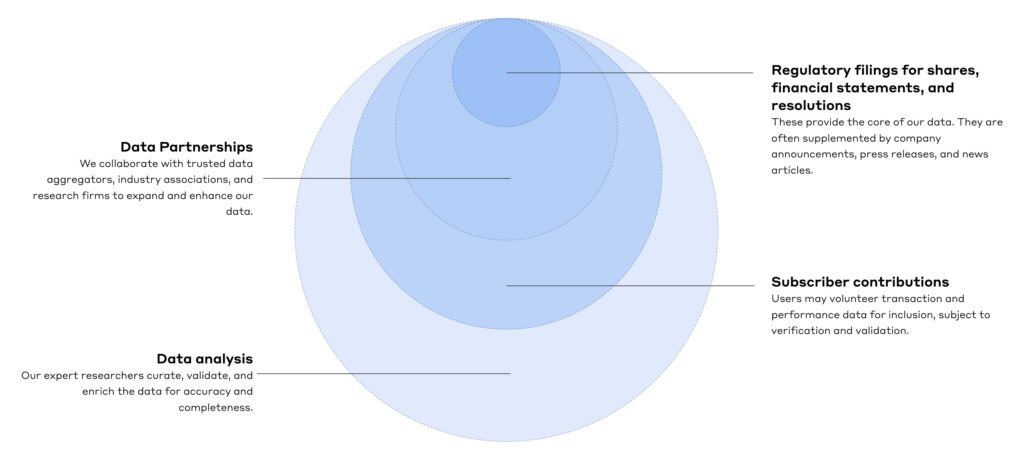

How we collect data

We use automated processes augmented by human curation.

Company Profiles

Profile data that includes name, sector, location, founding date, executives, directors with contacts, and employee count.

Company financial history

Financial performance with revenue, profitability, and growth rate, and access to full financial statements.

Company funding history

Investment dates, amounts, lead and participating investors, deal sizes, and share classes

Company Valuation

Accurate valuations, with multiples coming soon

Investor & Limited Partner profiles

Profiles of Investors, Limited Partners and Family Offices including preferences and track record.

Fund performance and preferences

Detailed performance data on fund entities investing in Southeast Asia and Australia, and insights into fund investment strategy.

Data done right

to help investors like you stay informed.